2016 house price rises reflected lower stock levels in Boroondara

A really interesting market dynamic has been playing out across Melbourne over the last 12 months…

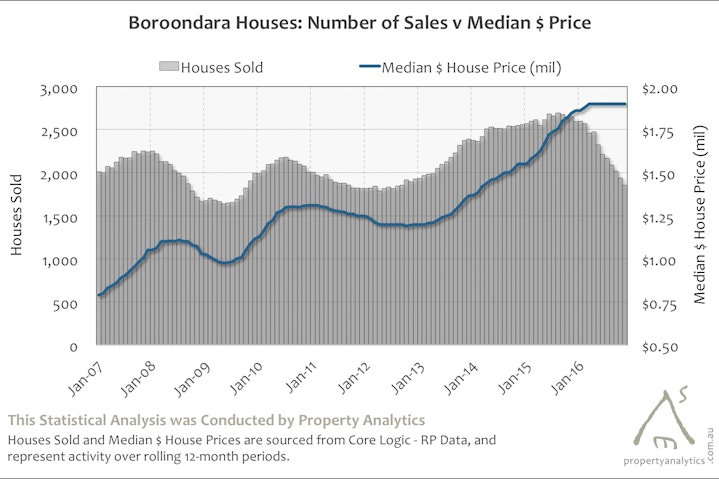

House Prices continue to rise (they’ve been increasing steadily since early 2013) but House Sales Volumes have been falling since January 2016.

Historically, volumes tend to move in-line with prices: as prices increase, more vendors choose to sell, and where prices flatten or decrease, fewer vendors choose to sell. There’s a positive correlation between the two, and this graph covering Boroondara Houses illustrates this pretty clearly.

But, look at what’s been happening recently – the number of Houses Sold has been decreasing steadily while the Median $ House Price has ticked up. Where about 20% fewer houses sold in 2016 compared to 2015, prices increased by about 10%. This is pretty unusual.

Talk to local agents and industry experts, and they’ll tell you that demand for quality housing remains very strong – from home buyers, investors, and foreign purchasers alike – but there’s just not enough stock to meet the need. The REIV reported a 75% Auction Clearance Rate for 2016, and this is evidence of strong competition between buyers.

So why are sales volumes so unusually low? There are a few reasonable explanations, ranging from global economic uncertainty, to domestic political fragility, and subdued consumer and business confidence. At a practical level, many potential vendors are reluctant to sell at a time when their purchase options are so limited (i.e. people don’t like to sell unless they have a property to move in to!). This scenario resonates most strongly with people looking to down-size into something other than an apartment. Unfortunately, it becomes a self-fulfilling market dynamic.

Whatever the reasons behind these recent trends, 2017 will prove to a very interesting year in Melbourne real estate. Interest Rates at record lows will continue to spur demand, and likely lead to continued price increases; the bigger question remains around sales volumes, and whether they will come back to historical averages over coming months.

One of the most obvious take-outs… It’s a good time to sell when so few competing properties are on the market. And, if you find a property that meets most of your needs, then snap it up.

Written By Andrew Stone, Property Analytics