How would you describe the 2025 property market?

Andrew: We’re seeing a more confident and active market than 2024, with an 80% auction clearance rate for Jellis Craig in the quarter ending June 2025 versus 75% during the same period last year.¹ Interest rate cuts and improved economic signals have encouraged buyers to re-engage, translating into higher clearance rates, more bidders and renewed momentum. We’re seeing the effect of these improved economic signals in our data, with Jellis Craig reporting a 15% increase in listings during the quarter ending June 2025 compared to the same period last year. Buyers continue to favour quality, well renovated, turnkey homes over the cost and complexity of renovating. There’s continued strength at the premium end, especially in blue-chip suburbs.

What macroeconomic forces are having an impact?

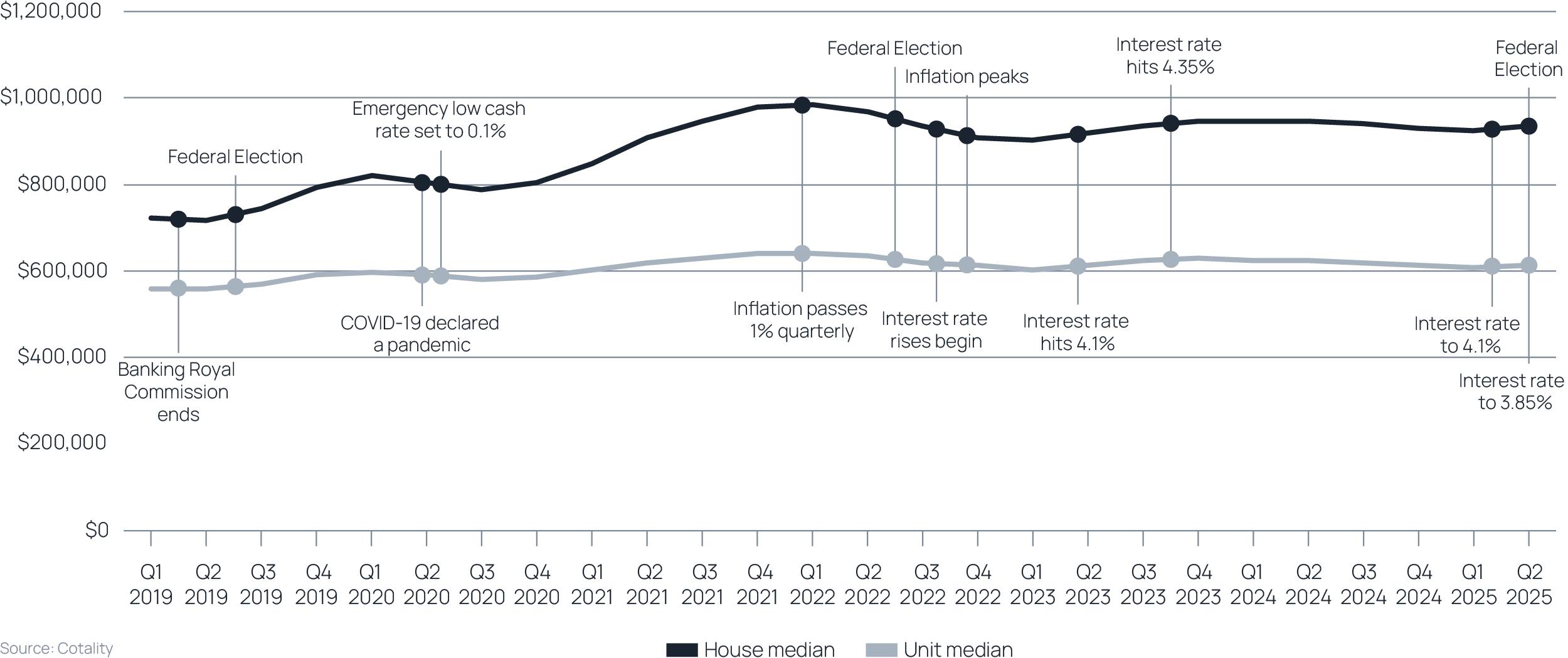

Tim: Interest rates, sentiment and affordability remain key. When rates fall, we typically see improved serviceability, higher borrowing capacity and a lift in buyer confidence, and that pattern is playing out now. Overseas migration is another major driver, with strong inflows from India, China and Korea boosting population growth and housing demand. With low unemployment, improving economic conditions and relative affordability, Victoria is well-positioned for upward price pressure for the remainder of the year.